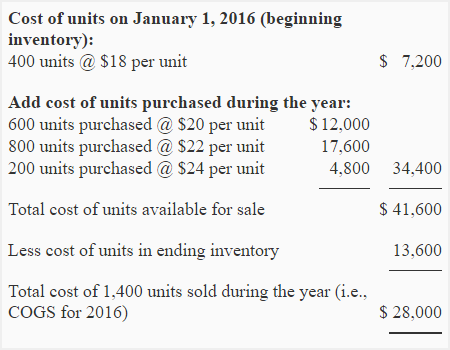

Cogs Formula. Cost of goods sold (cogs) is the cost of a product to a distributor, manufacturer or retailer. Cost of goods sold, often abbreviated cogs, is a managerial calculation that measures the direct costs incurred in producing products that were sold during a period.

Calculating the cost of goods sold (cogs) gives accountants and managers an accurate cogs takes into account the specific cost of inventory materials (including the costs associated directly with.

When calculating the cost of goods sold, do not include the cost of creating goods or services that you don't sell. Cost of goods sold gives the idea to a business person about his expenditure in procuring the material he wants to sell. The cost of goods sold formula is calculated by adding purchases for the period to the beginning during periods of rising prices, goods with higher costs are sold first, leading to a higher cogs. Cost of goods sold or cogs refers to the cost of producing goods and services.

0 Response to "Cogs Formula"

Posting Komentar